10 Medicare Mistakes That Cost Thousands | 2026 Prevention Guide

Medicare Mistakes That Can Cost You for Life

What Most People Aren't Told About Medicare — Until It's Too Late

Medicare Is Not Simple — And the Mistakes Are Often Permanent

Medicare is often described as "easy" or "automatic." In reality, it's a system full of rules, deadlines, penalties, and long-term consequences — many of which are never clearly explained.

Every year, people make Medicare decisions based on:

- Assumptions

- Incomplete advice

- Marketing instead of education

- Outdated information

And once certain Medicare mistakes are made, they can't be undone.

This page exists to help you avoid the most common — and costly — Medicare mistakes before they affect your health coverage or finances.

Why Medicare Mistakes Matter More Than People Realize

Some Medicare errors don't show up right away.

They appear later as:

- Lifetime premium penalties

- Higher out-of-pocket medical costs

- Limited plan choices

- Lost access to doctors or hospitals

- Forced plan changes

The hardest part? Many people don't realize they made a mistake until the window to fix it has already closed.

The 10 Most Common Medicare Mistakes (And How to Avoid Them)

Below is a growing education series designed to explain Medicare clearly — without pressure, sales tactics, or bias.

Each article focuses on one mistake, why it happens, and how to protect yourself.

Assuming Enrollment Is Automatic at 65

Many people believe Medicare starts automatically at 65. For many, it doesn't — and the penalties can last a lifetime.

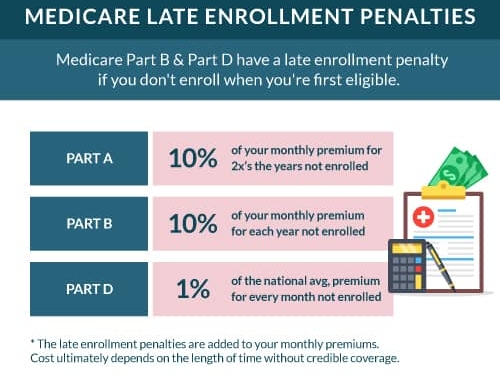

Read the full articleMissing Enrollment Deadlines That Trigger Penalties

Late enrollment penalties are permanent — and often avoidable with the right timing.

Read the full articleChoosing a Plan Based Only on the Monthly Premium

A $0 plan can still cost thousands. Premiums tell only part of the story.

Read the full articleNot Checking If Your Doctors Are In-Network

Plan networks change — and assuming your doctors are covered can disrupt care.

Read the full articleIgnoring Prescription Drug Coverage Until It's Too Late

Drug formularies change yearly. What's covered today may not be tomorrow.

Read the full articleKeeping the Same Plan Without an Annual Review

Plans change every year — even if you don't.

Read the full articleBeing Caught Off Guard When Your Plan Is Canceled

Plan terminations are becoming more common — and timing matters.

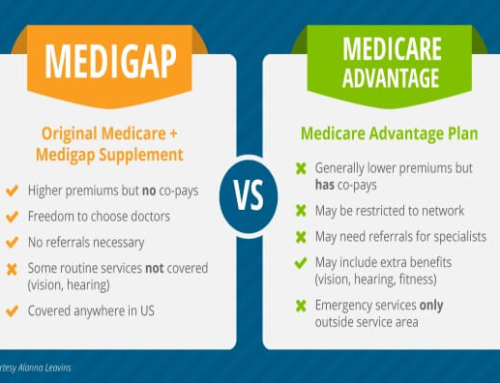

Read the full articleConfusing Medicare Advantage With Medicare Supplement Plans

These plans work very differently, and switching later may not be possible.

Read the full articleAssuming Medicare Covers All Medical Costs

Original Medicare has gaps — and no out-of-pocket limit.

Read the full articleRelying on Advice From the Wrong Source

Not all Medicare advice is unbiased — and that matters more than people realize.

Read the full articleWhy This Information Isn't Always Explained Clearly

Medicare information often comes from:

- Insurance companies (who can only discuss their own plans)

- Advertising-driven websites

- Friends or family with different situations

- Generic explanations from Medicare.gov that don't account for personal circumstances

What's missing is context — how Medicare rules apply to you.

That's where most mistakes happen.

Education First. Pressure Never.

The goal of this series isn't to push plans or tell you what to choose.

It's to help you:

- Understand the rules

- Recognize the risks

- Ask better questions

- Avoid irreversible decisions

Sometimes the best Medicare decision is staying exactly where you are — but only after confirming the facts.

Who This Series Is For

This information is especially important if you:

- Are turning 65 soon

- Are already on Medicare

- Have employer coverage and aren't sure how it coordinates

- Take prescription medications

- Want to avoid penalties and surprises

- Prefer clear explanations over sales pitches

The Bottom Line

Medicare mistakes don't usually come from carelessness. They come from assumptions, silence, and incomplete information.

Understanding Medicare before making decisions is the best protection you have.

This page will continue to grow as Medicare rules and plans evolve — because Medicare isn't static, and neither should your understanding of it.

Get Personalized Medicare Guidance

Want to understand how these rules apply to your specific situation?

As a Licensed Independent Medicare Advisor, I work for you — not for insurance companies. No pressure. No sales tactics. Just honest guidance based on your needs.