Medicare Mistake #2: Missing Enrollment Deadlines That Trigger Penalties

One of the most damaging Medicare mistakes doesn’t involve choosing the “wrong” plan.

It happens before you ever compare options.

That mistake is missing an enrollment deadline — often without realizing one even existed.

Unlike many insurance decisions, Medicare deadlines are not flexible. When you miss them, the consequences can be automatic, permanent, and expensive.

Why Medicare deadlines are so unforgiving

Medicare is governed by federal rules that rely on specific enrollment windows.

These windows open and close on fixed dates, regardless of whether you knew about them.

If you miss the window:

-

Coverage may be delayed

-

Penalties may apply

-

Your plan choices may be restricted

-

You may have to wait months (or longer) to fix it

And in many cases, no appeal is available.

The three deadlines that cause the most damage

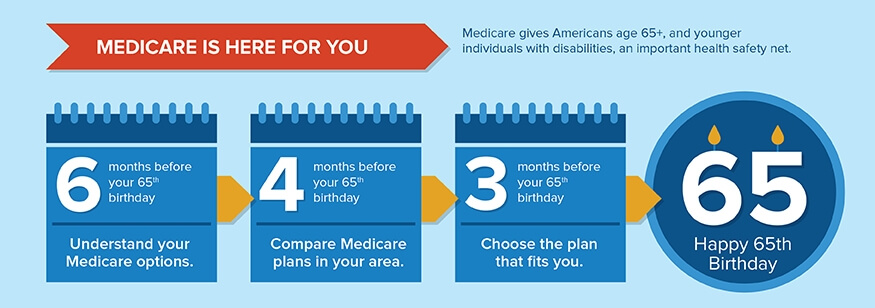

1) Initial Enrollment Period (IEP)

Your Initial Enrollment Period is a 7-month window:

-

3 months before your 65th birthday month

-

Your birthday month

-

3 months after

This window determines:

-

When coverage starts

-

Whether penalties apply

-

Whether you can enroll without restrictions

Miss this window, and you may be forced into a later enrollment with penalties attached.

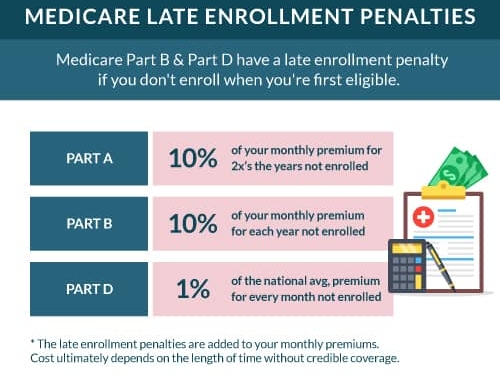

2) Part B late enrollment penalty

If you delay Medicare Part B without having qualifying employer coverage, Medicare applies a penalty that:

-

Increases your Part B premium

-

Lasts for the rest of your life

-

Grows the longer you delay

This penalty is added automatically.

It does not go away.

Many people are shocked to learn that even a short delay can have long-term consequences.

3) Part D (Prescription Drug) penalty

Prescription drug coverage has its own rules.

If you go 63 days or more without creditable drug coverage after becoming eligible, Medicare can:

-

Add a penalty to your Part D premium

-

Apply it permanently

-

Increase it every year

This often affects people who:

-

Don’t take medications now

-

Assume they can “add it later”

-

Believe drug coverage is optional

It isn’t — at least not without consequences.

“I thought I could just sign up later…”

This assumption causes more penalties than almost anything else.

Medicare does allow Special Enrollment Periods, but only under specific circumstances — such as:

-

Leaving employer coverage

-

Moving out of a plan’s service area

-

Losing creditable coverage

These exceptions are not automatic and often require documentation.

If you assume you qualify — and you don’t — the penalty still applies.

Annual deadlines people confuse or ignore

Even after you’re enrolled, timing still matters.

Every year:

-

Plans can change costs and benefits

-

Provider networks can change

-

Prescription formularies can change

Failing to act during the Annual Enrollment Period (AEP) doesn’t create penalties — but it can trap you in a plan that no longer fits your needs for an entire year.

In some cases, waiting too long means losing options you can’t get back.

Medicare won’t stop you from making this mistake

The official Medicare program (Medicare.gov) provides information, but it does not:

-

Monitor your enrollment status

-

Warn you before deadlines close

-

Notify you that penalties are about to apply

-

Tell you if your employer coverage qualifies

If a deadline passes, the system assumes responsibility was yours.

How to avoid deadline-related penalties entirely

Avoiding this mistake doesn’t require memorizing Medicare rules.

It requires knowing which deadlines apply to your situation.

Before enrolling, you should clearly understand:

-

When your enrollment window opens

-

When it closes

-

Whether your current coverage qualifies as creditable

-

What happens if you wait

A short review at the right time can prevent penalties that last decades.

The bottom line

Medicare deadlines are not suggestions.

They are rules with permanent consequences.

The people most affected by missed deadlines aren’t careless — they’re often well-insured, working, or simply misinformed.

Before making any Medicare decision, one question matters more than all others:

“Am I inside the correct enrollment window right now?”

Getting that answer right protects everything that follows.

Coming next in this series

Medicare Mistake #3: Choosing a Plan Based Only on the Monthly Premium