Medicare Mistake #3: Choosing a Plan Based Only on the Monthly Premium

One of the most common things people say when choosing a Medicare plan is:

“I just want the cheapest option.”

On the surface, that makes sense.

Why pay more if you don’t have to?

But in Medicare, focusing only on the monthly premium is one of the fastest ways to end up paying far more over the course of the year — often when you can least afford it.

Why the premium is only a small piece of the puzzle

A Medicare plan’s monthly premium is just the cost to have the plan.

It tells you almost nothing about what the plan will actually cost when you use it.

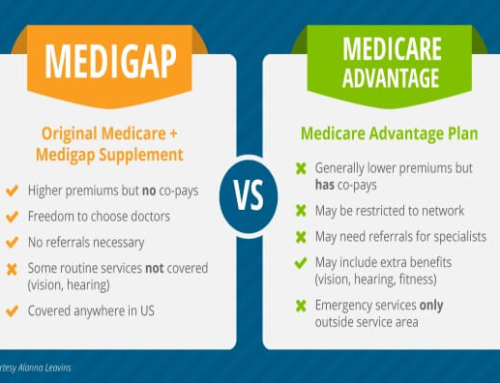

Plans with very low — or even $0 — premiums often shift costs elsewhere, such as:

-

Doctor visit copays

-

Specialist fees

-

Hospital charges

-

Outpatient procedures

-

Prescription drug tiers

-

Annual out-of-pocket limits

These costs don’t show up until you need care.

The hidden cost most people overlook: out-of-pocket exposure

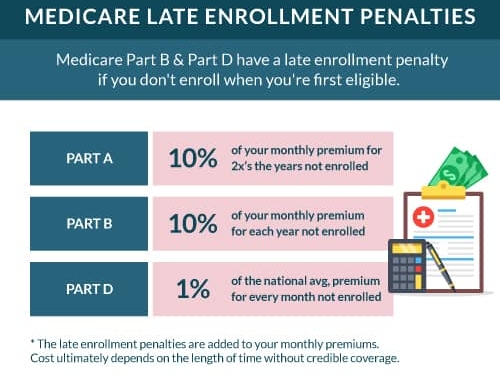

Every Medicare Advantage plan has a Maximum Out-of-Pocket (MOOP) amount.

This is the most you could pay in a year if you have significant medical needs.

Two plans might look like this:

-

Plan A: $0 premium, $7,500 maximum out-of-pocket

-

Plan B: $75 premium, $3,000 maximum out-of-pocket

On paper, Plan A looks cheaper.

In reality, one hospital stay could cost thousands more.

People who choose plans based only on premiums often don’t realize how exposed they are until after something happens.

“But I’m healthy — I never go to the doctor”

This is another common assumption that leads to regret.

Health can change quickly — especially as we age.

An accident, diagnosis, or unexpected hospital visit can turn a “cheap” plan into a financial shock.

Medicare decisions aren’t just about how you feel today.

They’re about how much risk you’re willing to carry if something changes.

Prescription costs can erase premium savings overnight

Drug coverage is another area where premium-only decisions fall apart.

A plan may:

-

Cover your current medications today

-

Place them on higher tiers next year

-

Require prior authorization

-

Increase copays without warning

A plan that saves $50 a month on premiums can easily cost hundreds more in prescription expenses over the year.

Why this mistake keeps happening

Many Medicare ads emphasize:

-

“$0 premium”

-

“Extra benefits”

-

“Money back each month”

What they don’t emphasize:

-

Total annual cost

-

Risk exposure

-

How benefits work in real life

-

What happens if your health changes

The premium is easy to compare.

The risk is harder to see — until it’s too late.

Medicare doesn’t rank plans by “best value”

The official Medicare system (Medicare.gov) allows you to compare plans, but it does not:

-

Tell you which plan is safest

-

Warn you about risk exposure

-

Evaluate plans based on your financial tolerance

-

Explain how multiple costs interact over a year

That responsibility is yours.

A smarter way to evaluate Medicare plans

Instead of asking:

“What’s the cheapest premium?”

A better question is:

“What could this plan realistically cost me in a bad year?”

A proper review looks at:

-

Monthly premium

-

Copays and coinsurance

-

Prescription coverage

-

Provider access

-

Maximum out-of-pocket risk

-

Your health history and priorities

Sometimes the lowest premium is the right choice — but only after confirming the tradeoffs.

The bottom line

In Medicare, the cheapest plan upfront is often the most expensive plan later.

Monthly premiums are only one piece of the puzzle, and focusing on them alone can leave you exposed to costs you never expected.

The goal isn’t to find the cheapest plan.

It’s to find the plan that protects you best when you actually need it.

Coming next in this series

Medicare Mistake #4: Not Checking If Your Doctors Are In-Network