Medicare Mistake #4: Not Checking If Your Doctors Are In-Network

One of the most painful Medicare surprises happens after enrollment — when someone goes to schedule an appointment and hears:

“We no longer accept your plan.”

For many Medicare beneficiaries, that moment comes out of nowhere.

They chose a plan, paid their premium, and assumed their doctors would remain available.

Unfortunately, that assumption leads to one of the most disruptive Medicare mistakes.

Why doctor networks matter more than people realize

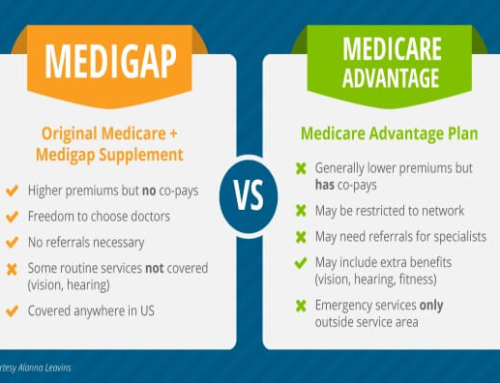

Many Medicare plans — especially Medicare Advantage plans — use provider networks.

That means:

-

Some doctors are included

-

Others are excluded

-

Referrals may be required

-

Coverage rules vary by plan type

Unlike Original Medicare, where you can see any provider who accepts Medicare, network-based plans limit where you can go and who you can see.

Networks can change — even if your plan doesn’t

A common misconception is:

“I’ve had this plan for years, so my doctor must still be covered.”

In reality:

-

Providers can leave networks

-

Contracts can change

-

Medical groups can drop plans

-

Hospitals can become out-of-network

These changes often happen year to year, and sometimes mid-year.

If you don’t check, you won’t know until you try to use your coverage.

The difference between HMO and PPO matters

Not all Medicare Advantage plans work the same way.

HMO plans

-

Require in-network care (except emergencies)

-

Usually require referrals

-

Offer lower premiums

-

Offer less flexibility

PPO plans

-

Allow some out-of-network care

-

May not require referrals

-

Cost more, but offer more freedom

Choosing between these is not about which one is “better.”

It’s about which one fits how you actually use healthcare.

Specialists are where this mistake hurts most

Primary care doctors are often easy to verify.

Specialists are where problems arise.

Examples:

-

A cardiologist not in your network

-

A cancer center excluded from coverage

-

A preferred hospital system dropped

If you need specialized care, being out-of-network can mean:

-

Much higher costs

-

Denied coverage

-

Starting over with a new provider

For people managing chronic conditions, this can be life-disrupting.

“But my doctor told me they take my plan…”

This is another common trap.

Doctor offices may:

-

Accept Medicare but not your specific plan

-

Be in-network today but not next year

-

Be unsure of contract status

-

Give outdated information

The only reliable confirmation is checking the plan’s official provider directory — and even that should be verified close to enrollment.

Medicare doesn’t guarantee network accuracy

The official Medicare system (Medicare.gov) displays provider information, but it:

-

Relies on data from insurance companies

-

May not reflect recent changes

-

Cannot guarantee a provider will accept your plan at your appointment

This makes double-checking essential.

How to avoid this mistake

Before choosing or renewing a Medicare plan, you should confirm:

-

Your primary care doctor is in-network

-

Key specialists are in-network

-

Your preferred hospitals are covered

-

Referral requirements (if any)

-

Whether out-of-network care is allowed

This should be done every year, not just once.

The bottom line

Your Medicare plan is only as good as the doctors and hospitals you can access.

Failing to check provider networks can disrupt care, increase costs, and force you to make difficult healthcare decisions under pressure.

Before enrolling or renewing, one simple question can save you a lot of stress:

“Can I still see the doctors I trust?”

Coming next in this series

Medicare Mistake #5: Ignoring Prescription Drug Coverage Until It’s Too Late