Medicare Mistake #5: Ignoring Prescription Drug Coverage Until It’s Too Late

Many people on Medicare say the same thing when asked about prescription coverage:

“I don’t take many medications, so I’ll worry about that later.”

Unfortunately, that mindset leads to one of the most expensive and frustrating Medicare mistakes — ignoring prescription drug coverage until a problem appears.

By the time it does, the options to fix it may be limited, costly, or permanently restricted.

Why prescription coverage deserves more attention

Prescription drug coverage under Medicare (Part D) is not optional without consequences.

Even if you don’t take medications today:

-

Your health can change

-

Drug prices can increase

-

Formularies can change

-

Penalties can apply retroactively

Part D is designed to protect you before you need it — not after.

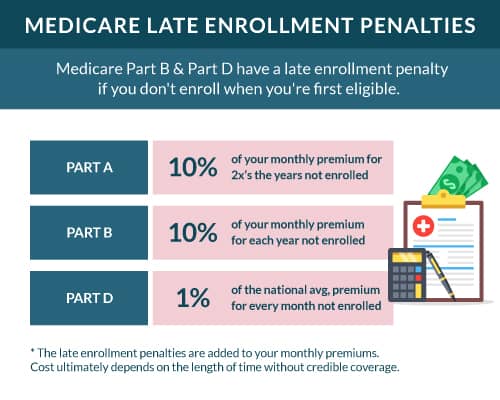

The penalty many people never see coming

If you go 63 days or more without creditable prescription drug coverage after becoming eligible for Medicare, Medicare can apply a late enrollment penalty.

This penalty:

-

Is added to your Part D premium

-

Applies for as long as you have Medicare

-

Increases the longer you go without coverage

The penalty doesn’t disappear when you finally enroll.

It follows you permanently.

“My medications are covered now — so I’m fine”

Prescription coverage isn’t static.

Every year:

-

Drug formularies change

-

Tiers are adjusted

-

Copays increase

-

Prior authorizations are added

-

Pharmacies may leave networks

A medication that’s affordable today could become expensive or restricted next year — even if you stay on the same plan.

This is why prescription reviews matter annually, not just at enrollment.

The danger of assuming “all plans are the same”

Two Medicare plans can look identical on the surface but handle prescriptions very differently.

Differences may include:

-

Which drugs are covered

-

Tier placement

-

Preferred vs non-preferred pharmacies

-

Quantity limits

-

Step therapy requirements

Choosing a plan without reviewing prescriptions carefully can turn a manageable monthly cost into a financial burden.

“I’ll just add drug coverage later”

This is another common assumption — and a risky one.

Outside of specific enrollment windows, you may not be able to add or change prescription coverage when you want.

If you miss the right timing:

-

You may have to wait months to enroll

-

Penalties may already apply

-

Certain plans may be unavailable

Waiting removes control from the decision.

Medicare doesn’t tailor prescription advice to you

The official Medicare program (Medicare.gov) provides plan comparison tools, but it does not:

-

Track your medication history

-

Warn you when formularies change

-

Predict future drug needs

-

Alert you when penalties apply

The responsibility to review coverage falls on you.

How to avoid this mistake entirely

Avoiding prescription-related Medicare mistakes requires reviewing:

-

Your current medications

-

Potential future needs

-

Pharmacy preferences

-

Total annual drug costs — not just monthly premiums

Even if you take no medications today, having creditable coverage protects you from penalties and keeps your options open.

The bottom line

Prescription drug coverage isn’t just about what you take today.

It’s about protecting yourself from future costs, penalties, and limitations.

Ignoring Part D can quietly create lifelong consequences — often without any immediate warning.

Before choosing or renewing a Medicare plan, one question matters more than most:

“How will this plan handle my prescriptions if things change?”

Coming next in this series

Medicare Mistake #6: Keeping the Same Plan Without an Annual Review