Medicare Mistake #7: Being Caught Off Guard When Your Plan Is Canceled

Many Medicare beneficiaries believe that once they choose a plan, it will always be there.

Unfortunately, that’s not how Medicare works.

Every year, plans can:

-

Exit a county

-

Be discontinued by the carrier

-

Merge into a different plan

-

Change in ways that effectively end the coverage you relied on

When this happens, people are often caught completely off guard — and forced to make decisions under pressure.

Why Medicare plans get canceled

Medicare plans are offered by private insurance companies under contracts that are renewed annually.

A plan may be canceled because:

-

The carrier leaves a specific county or state

-

Enrollment numbers are too low

-

Costs increase beyond what the carrier is willing to absorb

-

The carrier restructures or merges plans

-

CMS regulations change

None of this has anything to do with you personally — but the impact lands squarely on you.

How people usually find out (too late)

Most people don’t realize their plan is ending until:

-

They receive an unfamiliar letter in the mail

-

They ignore it, assuming it’s routine

-

January arrives and coverage looks different

-

A doctor visit or prescription is denied

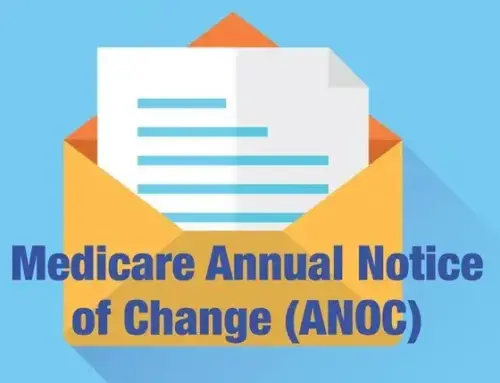

The notice is often included in the Annual Notice of Change (ANOC) or sent as a separate non-renewal letter.

If that letter is missed or misunderstood, the consequences can be immediate.

What happens if you do nothing

If your Medicare plan is canceled and you don’t actively choose a new one, Medicare may:

-

Automatically enroll you into a different plan

-

Default you to Original Medicare without drug coverage

-

Assign a plan that doesn’t include your doctors or medications

Auto-enrollment is meant as a safety net — not a tailored solution.

What you’re enrolled into may not:

-

Fit your healthcare needs

-

Control your costs

-

Protect you from risk

-

Include your preferred providers

Why this mistake is especially disruptive

Plan cancellations don’t just affect paperwork. They can:

-

Interrupt ongoing treatment

-

Force provider changes

-

Increase out-of-pocket costs

-

Limit plan options for an entire year

If you’re managing chronic conditions or seeing specialists, the disruption can be serious.

And because timing matters, missing the response window can permanently reduce your choices.

Medicare won’t tell you what to choose

The official Medicare system (Medicare.gov) requires plans to notify members of cancellations, but it does not:

-

Evaluate replacement plans for you

-

Compare your options based on risk

-

Confirm doctor or prescription compatibility

-

Warn you which option is safest

The responsibility to act — and act wisely — is yours.

How to protect yourself from plan cancellation surprises

You can avoid this mistake by:

-

Reading every Medicare notice you receive

-

Reviewing your ANOC each fall

-

Confirming whether your plan is renewing

-

Reviewing options during Annual Enrollment

-

Acting early rather than waiting until the deadline

A short review before the year ends can prevent rushed decisions later.

When plan cancellations create opportunity

While plan cancellations are disruptive, they also open doors.

When a plan ends, you often receive:

-

A guaranteed opportunity to choose a new plan

-

Access to options you may not have had otherwise

-

A chance to reassess coverage with fresh eyes

Handled proactively, a cancellation doesn’t have to be a setback — it can be a reset.

The bottom line

Medicare plans are not permanent.

Being surprised by a plan cancellation can lead to rushed choices, higher costs, and disrupted care — but it’s entirely preventable.

Each fall, one question can protect you from unnecessary stress:

“Is my plan renewing next year — and if not, what should I do?”

Knowing the answer before January makes all the difference.

Coming next in this series

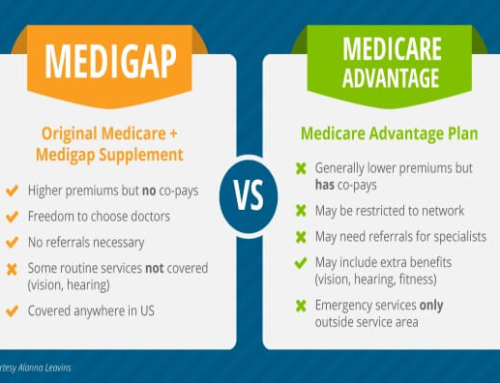

Medicare Mistake #8: Confusing Medicare Advantage With Medicare Supplement Plans

Real-World Medicare Plan Cancellation Scenarios

Medicare plan cancellations rarely feel dramatic at first.

They usually start with a letter — and end with confusion, disruption, or higher costs if not handled properly.

Scenario #1: “My plan is no longer offered in my county”

What happened:

A Medicare Advantage carrier decided to exit several counties due to low enrollment and rising costs.

What the member received:

A notice stating:

“This plan will not be available in your area next year.”

What went wrong:

The member assumed Medicare would “handle it.”

What actually happened:

-

The member was auto-enrolled into a different plan

-

Their primary care doctor was no longer in-network

-

Prescription copays increased significantly

The member could have chosen a better option — but only if they acted before the deadline.

Scenario #2: Plan merger that changed coverage

What happened:

A carrier merged two plans into one “replacement” plan.

What the member expected:

Similar benefits and costs.

What changed:

-

Higher specialist copays

-

New prior authorization rules

-

A smaller provider network

Technically, the plan still existed — but it worked very differently.

Because the member didn’t review the changes, they were locked in for the year.

Scenario #3: Prescription coverage drug plan discontinued

What happened:

A standalone Part D prescription plan was discontinued.

What the member assumed:

Any new drug plan would be “about the same.”

What actually happened:

-

Medicare assigned a new drug plan automatically

-

Several medications were no longer on the formulary

-

Monthly prescription costs doubled

Had the member actively selected a plan, they could have avoided the disruption.

Scenario #4: Carrier exits a state entirely

What happened:

A smaller regional carrier pulled out of a state altogether.

What the member experienced:

-

Their plan ended December 31

-

They were granted a Special Enrollment Period

-

They didn’t realize the SEP had a time limit

By the time they acted, plan choices were more limited and costs were higher.

Scenario #5: “I didn’t open the letter”

What happened:

The member received a non-renewal notice but mistook it for marketing mail.

What they discovered in January:

-

Their old plan no longer existed

-

Their doctors were no longer covered

-

Their prescriptions required new authorizations

At that point, options were limited and changes had to wait.

Why these scenarios happen so often

Medicare plan changes are:

-

Legal

-

Common

-

Announced in writing

-

Easy to overlook

The official Medicare system (Medicare.gov) requires plans to notify members — but it does not:

-

Explain what the change means for you

-

Recommend replacement plans

-

Ensure your doctors or prescriptions are covered

-

Stop auto-enrollment into sub-optimal options

The key takeaway

Plan cancellations are not rare — and they’re not emergencies if handled early.

The people most affected are not careless.

They simply didn’t realize:

-

The plan was ending

-

Action was required

-

Time limits applied

Reading notices and reviewing options during Annual Enrollment prevents rushed decisions later.

How this fits into the Medicare Mistakes series

These scenarios reinforce why Medicare Mistake #7 isn’t about choosing the “wrong” plan — it’s about not realizing your plan is ending and missing the chance to choose what comes next.