Medicare Supplement vs. Medicare Advantage: What You Don’t Know Will Cost You

If you look at the statistics, it feels obvious.

The majority of people enrolling in Medicare today choose Medicare Advantage plans. That alone would make you assume they must be the better option.

More people choose them.

More ads promote them.

More agents talk about them.

But popularity does not mean superiority—especially when it comes to Medicare.

The real question isn’t why so many people choose Medicare Advantage.

The real question is why so many people never realize they had a different choice at all.

Why Medicare Advantage Enrollment Is So High

There are two main reasons Medicare Advantage plans dominate enrollment.

1. For some people, they truly are the best—or only—option

Let’s get this out of the way first.

Medicare Advantage plans are not bad plans.

They can be a great fit for people who:

-

Cannot afford a monthly Supplement premium

-

Qualify for special programs

-

Prefer bundled coverage with extras like dental and vision

-

Are comfortable with managed care and provider networks

For many beneficiaries, Medicare Advantage is the most practical choice.

2. Many people are never told there is an alternative

This is where the problem starts.

The Medicare industry is financially tilted toward Medicare Advantage.

Why?

Because Medicare Advantage plans pay roughly double what Medicare Supplement plans pay to:

-

Insurance companies

-

Agencies

-

Agents

-

Call center representatives

That doesn’t mean anyone is lying—but it does mean the system rewards one conversation more than another.

So what happens?

Many people enroll in Medicare Advantage without ever being clearly educated on:

-

What Medicare Supplement plans are

-

How they work

-

Or what they’re giving up by choosing Advantage

The $0 Premium Decision That Feels Smart—At First

This is the moment that convinces almost everyone.

You’re new to Medicare and you see:

-

$0 monthly premium

-

Prescription drug coverage included

-

Dental, vision, and hearing benefits

You think:

“Why would I pay a monthly premium when I rarely go to the doctor?”

That logic is completely reasonable—when you’re healthy.

And for several years, it works.

-

You see the doctor once or twice a year

-

Your costs are low

-

Everything seems fine

Until one day, it isn’t.

When Health Changes, the Rules Change

This is the story I hear every single week.

Someone is diagnosed with:

-

Cancer

-

Heart disease

-

A serious autoimmune condition

-

Or they need a hip or knee replacement

-

Or they suffer a stroke or heart attack

That’s when they start asking questions.

That’s when they finally hear about Medicare Supplement plans.

And that’s when they learn the truth:

“I can’t get one now.”

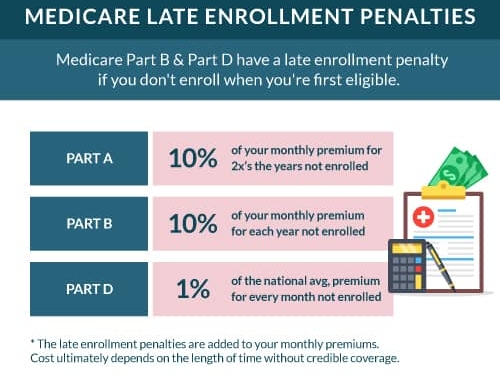

The Medicare Rule No One Explains Early Enough

When you first enroll in Medicare, you have a limited window where you can purchase a Medicare Supplement without medical underwriting.

Once that window closes:

-

You can be denied

-

You can be charged more

-

Or you may have no Supplement options at all

This is why so many people learn about Supplements after they get sick—when it’s too late.

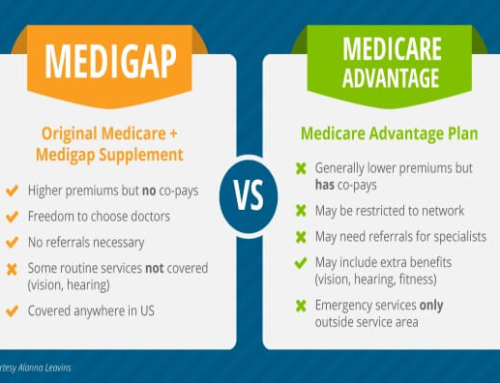

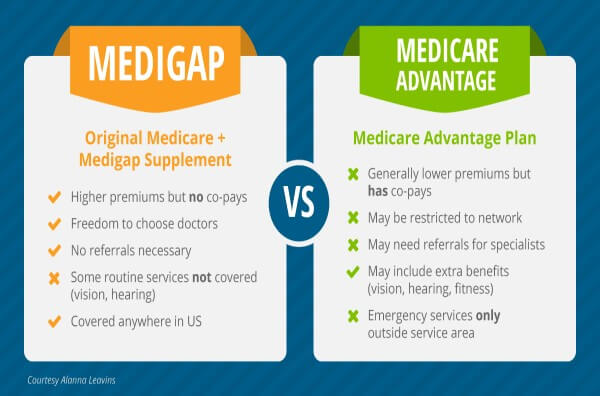

Medicare Supplement vs. Medicare Advantage: The Real Difference

Medicare Supplement (Medigap):

-

See any doctor nationwide who accepts Medicare

-

No networks

-

No referrals

-

No prior authorizations for most services

-

Predictable costs

-

Medicare remains in control—not an insurance company

Medicare Advantage:

-

Replaces Original Medicare

-

Controlled by a private insurance carrier

-

Requires networks and approvals

-

Often includes referrals and prior authorizations

-

Higher out-of-pocket exposure during serious illness

A simple way to think about it:

With Medicare Advantage, you are no longer really on Medicare—you are on a private insurance plan that replaces it.

Why Supplements Usually Win When Health Declines

When you’re healthy, Advantage plans often appear cheaper.

When you’re sick, Supplement plans almost always come out ahead.

Why?

-

No network limitations

-

No fighting for approvals

-

No wondering whether your specialist is “in network”

-

Lower total out-of-pocket costs during major medical events

That’s why people with serious diagnoses almost always wish they had chosen a Supplement—if they had known.

My Objection Isn’t to Medicare Advantage

Medicare Advantage plans are not the enemy.

They are the right solution for many people.

My objection is simple:

People deserve to understand both options before making a decision they may never be able to undo.

Too many seniors choose a plan based on:

-

A $0 premium

-

Extra benefits

-

Incomplete information

And they don’t discover the downside until their health forces the issue.

The Question Everyone Should Ask Before Enrolling

Before choosing any Medicare plan, ask yourself this:

“If my health changes in five or ten years, will I still be comfortable with this decision?”

If no one has explained both Medicare Advantage and Medicare Supplement options to you clearly, then you haven’t been educated—you’ve been processed.

And Medicare decisions are too important for that.