Why Medicare Advantage Plans Are So Attractive? Is It Right For You?

Why Medicare Advantage Plans Are So Attractive — Especially at First

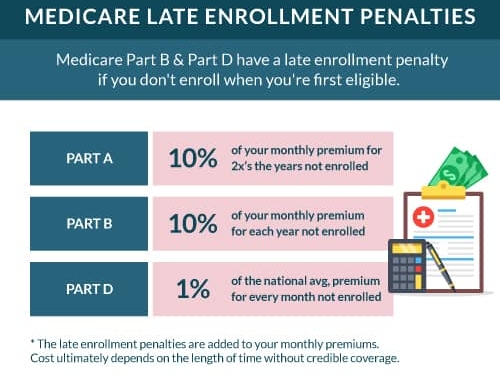

When people first become Medicare-eligible, many are shocked by how quickly the costs start adding up. Medicare is often described as “free” or “government health insurance,” but that illusion disappears the moment Part B begins.

In 2026, the standard Medicare Part B premium is $202.90 per month. That premium starts the day you enroll — whether you see a doctor or not.

Now imagine you’re 65, feeling healthy, and you only see a doctor once or twice a year. You take maybe one prescription, or none at all. From that perspective, paying an additional $150–$300 per month for a Medicare Supplement plan can feel unnecessary, unrealistic, or flat-out unaffordable.

That’s where Medicare Advantage plans step in — and why they’re so appealing to so many people.

1. They Make Financial Sense Right Now

For healthy retirees, the math is hard to ignore.

You’re already paying:

- $202.90/month for Part B

So when someone says:

“Why would I pay another $200+ every month when I barely use my insurance?”

…it’s a fair question.

Many Medicare Advantage plans offer:

- $0 monthly premiums

- Or very low premiums (sometimes under $50)

For someone living on Social Security or a fixed income, that difference alone can be the deciding factor.

2. “I’m Healthy — I’ll Deal With It Later”

A huge percentage of people enrolling in Medicare are genuinely healthy:

- No chronic conditions

- Rare doctor visits

- No major prescriptions

- Active lifestyles

When you’re in that position, insurance feels like something you might need someday — not something you need today.

Medicare Advantage plans are designed to match that mindset:

- Pay as you go

- Low upfront cost

- Coverage is there if you need it

For many people, it feels logical, responsible, and practical.

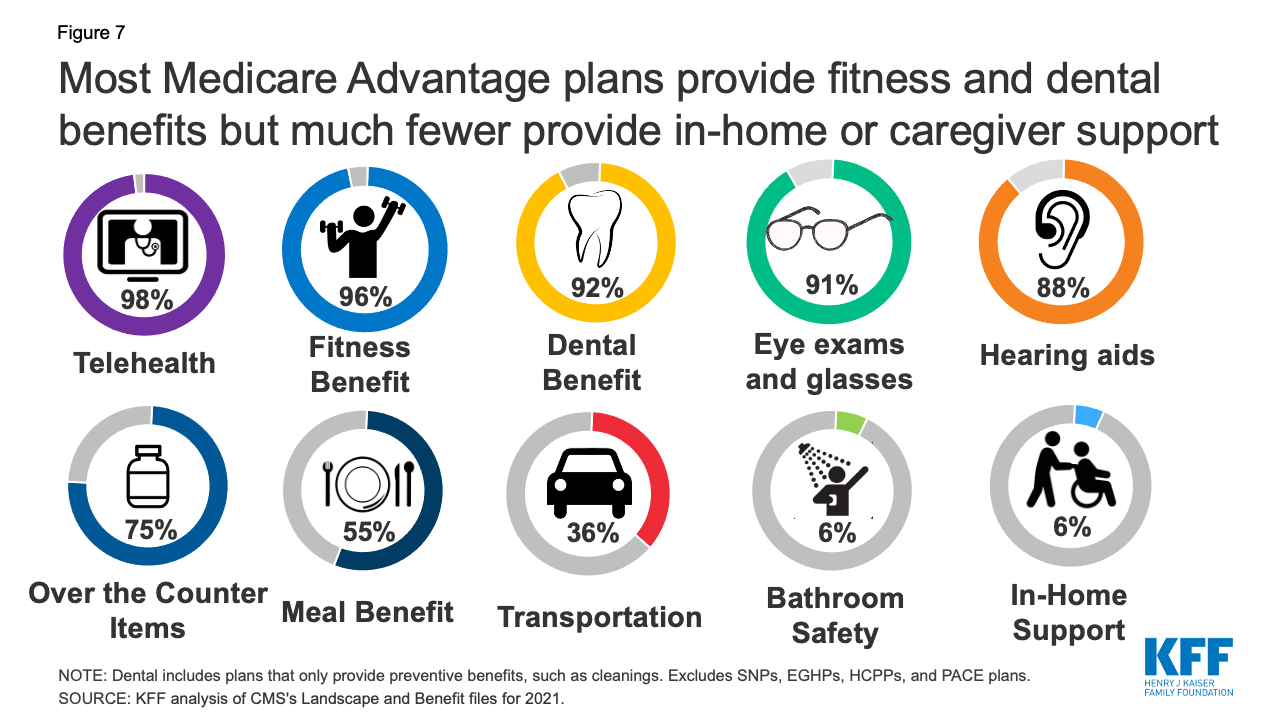

3. Built-In Benefits People Actually Want

This is where Advantage plans really shine from a marketing standpoint.

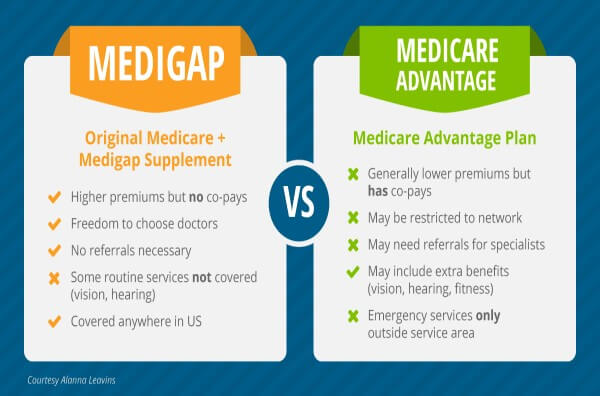

Most Medicare Advantage plans bundle things Original Medicare does not cover, such as:

- Dental (cleanings, exams, sometimes major work)

- Vision (eye exams, glasses, contacts)

- Hearing (exams and hearing aids)

- Prescription drug coverage (Part D included)

- Fitness memberships (SilverSneakers, gyms, classes)

- Over-the-counter allowances

- Transportation to medical appointments

- Meal benefits after hospital stays

To someone new to Medicare, this feels like a complete health plan — similar to employer coverage they had before retirement.

And when it’s offered at $0 per month, it feels almost too good to pass up.

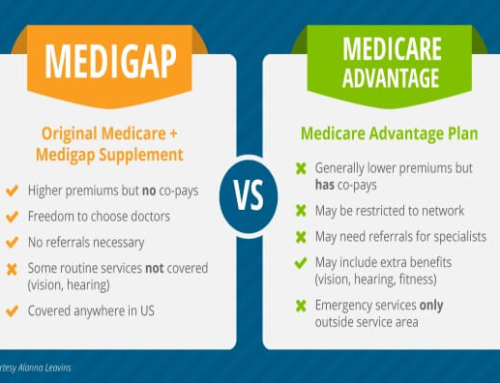

4. Simple. Familiar. Packaged.

Medicare Advantage plans are often structured like the insurance people already know:

- HMO or PPO networks

- Copays instead of coinsurance

- Prescription cards

- One ID card for everything

Compare that to:

- Original Medicare + Supplement + Drug Plan

- Multiple cards

- Multiple premiums

- Multiple policies

Advantage plans feel simpler, especially for someone just trying to get through enrollment without making a mistake.

5. The Carriers Make Them Extremely Enticing — On Purpose

Here’s a reality most people are never told:

Insurance carriers would much rather have you on a Medicare Advantage plan than a Supplement plan.

Why?

- Advantage plans allow carriers to manage care

- They receive fixed payments per member

- Costs are more predictable

- Profit potential is higher when care is controlled

Because of this, carriers:

- Load Advantage plans with attractive extras

- Advertise them heavily

- Promote the $0 premium front and center

- Emphasize benefits people feel they’re missing out on

This doesn’t mean Advantage plans are bad.

It means they are strategically designed to be irresistible, especially to healthy, cost-conscious new beneficiaries.

6. They Feel Like the “Smart” Choice at 65

When you’re healthy, watching your budget, and trying to avoid overpaying for insurance you may never use, Medicare Advantage plans often feel like the smartest decision available.

And for some people, they truly are a good fit — at least for a period of time.

The problem isn’t that Medicare Advantage plans exist.

The problem is that many people choose them without fully understanding all of their options, or how those choices can affect them later.

But it’s easy to see why so many people say “yes” to Advantage plans.

They’re affordable.

They’re familiar.

They’re packed with benefits.

And they’re presented as the obvious choice.

And for someone who’s healthy today, that can make perfect sense.

In the next article, we’ll talk about what doesn’t get discussed nearly enough — and why timing, health changes, and long-term planning matter more than most people realize when choosing a Medicare plan.