Why Medicare Advantage Plans Are So Attractive? Is It Right For You?

Why Medicare Advantage Plans Are So Attractive — Especially at First When people first become Medicare-eligible, many are shocked by how quickly the costs start adding up. Medicare is often described as “free” or “government health insurance,” but that illusion disappears the moment Part B begins. In 2026, the standard Medicare Part B premium is $202.90 per month. That premium starts the day you enroll — whether you see a doctor or not. Now imagine you’re 65, feeling healthy, and you only see a doctor once or twice a year. You take maybe one prescription, or none at all. From [...]

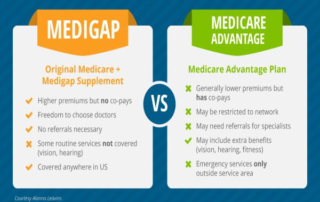

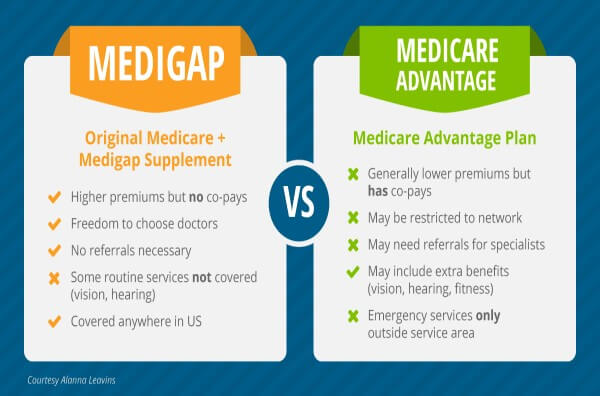

Medicare Supplement vs. Medicare Advantage: What You Don’t Know Will Cost You

If you look at the statistics, it feels obvious. The majority of people enrolling in Medicare today choose Medicare Advantage plans. That alone would make you assume they must be the better option. More people choose them.More ads promote them.More agents talk about them. But popularity does not mean superiority—especially when it comes to Medicare. The real question isn’t why so many people choose Medicare Advantage. The real question is why so many people never realize they had a different choice at all. Why Medicare Advantage Enrollment Is So High There are two main reasons Medicare Advantage plans dominate [...]

Medicare Mistake #7: Being Caught Off Guard When Your Plan Is Canceled

Many Medicare beneficiaries believe that once they choose a plan, it will always be there. Unfortunately, that’s not how Medicare works. Every year, plans can: Exit a county Be discontinued by the carrier Merge into a different plan Change in ways that effectively end the coverage you relied on When this happens, people are often caught completely off guard — and forced to make decisions under pressure. Why Medicare plans get canceled Medicare plans are offered by private insurance companies under contracts that are renewed annually. A plan may be canceled because: The carrier leaves a specific county or [...]

Medicare Mistake #6: Keeping the Same Plan Without an Annual Review

Many people assume that if their Medicare plan worked last year, it will work again this year. That assumption feels reasonable.It’s also one of the most common Medicare mistakes. Unlike many types of insurance, Medicare plans are allowed to change every single year—even if you make no changes at all. What actually changes from year to year Each fall, Medicare plans can update: Monthly premiums Copays and coinsurance Provider networks Prescription drug formularies Prior authorization rules Extra benefits and limits These changes are legal, expected, and routine. What’s not routine is people reviewing them. The document most people never [...]

Medicare Mistake #5: Ignoring Prescription Drug Coverage Until It’s Too Late

Many people on Medicare say the same thing when asked about prescription coverage: “I don’t take many medications, so I’ll worry about that later.” Unfortunately, that mindset leads to one of the most expensive and frustrating Medicare mistakes — ignoring prescription drug coverage until a problem appears. By the time it does, the options to fix it may be limited, costly, or permanently restricted. Why prescription coverage deserves more attention Prescription drug coverage under Medicare (Part D) is not optional without consequences. Even if you don’t take medications today: Your health can change Drug prices can [...]

Medicare Mistake #4: Not Checking If Your Doctors Are In-Network

One of the most painful Medicare surprises happens after enrollment — when someone goes to schedule an appointment and hears: “We no longer accept your plan.” For many Medicare beneficiaries, that moment comes out of nowhere.They chose a plan, paid their premium, and assumed their doctors would remain available. Unfortunately, that assumption leads to one of the most disruptive Medicare mistakes. Why doctor networks matter more than people realize Many Medicare plans — especially Medicare Advantage plans — use provider networks. That means: Some doctors are included Others are excluded Referrals may be required Coverage rules vary by plan type [...]

Medicare Mistake #3: Choosing a Plan Based Only on the Monthly Premium

One of the most common things people say when choosing a Medicare plan is: “I just want the cheapest option.” On the surface, that makes sense.Why pay more if you don’t have to? But in Medicare, focusing only on the monthly premium is one of the fastest ways to end up paying far more over the course of the year — often when you can least afford it. Why the premium is only a small piece of the puzzle A Medicare plan’s monthly premium is just the cost to have the plan.It tells you almost nothing about what the plan [...]

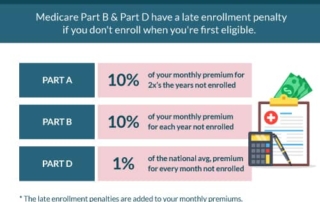

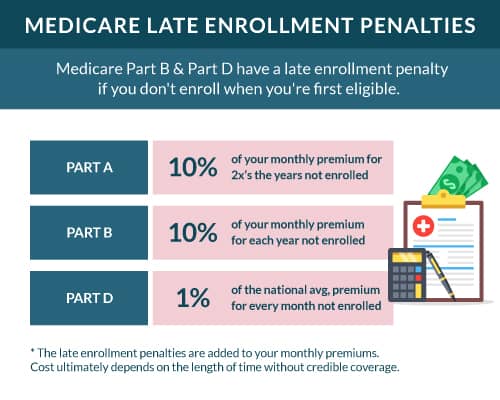

Medicare Mistake #2: Missing Enrollment Deadlines That Trigger Penalties

One of the most damaging Medicare mistakes doesn’t involve choosing the “wrong” plan.It happens before you ever compare options. That mistake is missing an enrollment deadline — often without realizing one even existed. Unlike many insurance decisions, Medicare deadlines are not flexible. When you miss them, the consequences can be automatic, permanent, and expensive. Why Medicare deadlines are so unforgiving Medicare is governed by federal rules that rely on specific enrollment windows.These windows open and close on fixed dates, regardless of whether you knew about them. If you miss the window: Coverage may be delayed Penalties may apply Your plan [...]

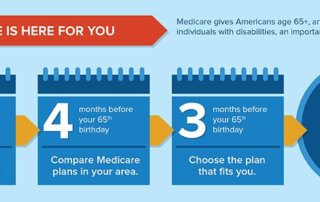

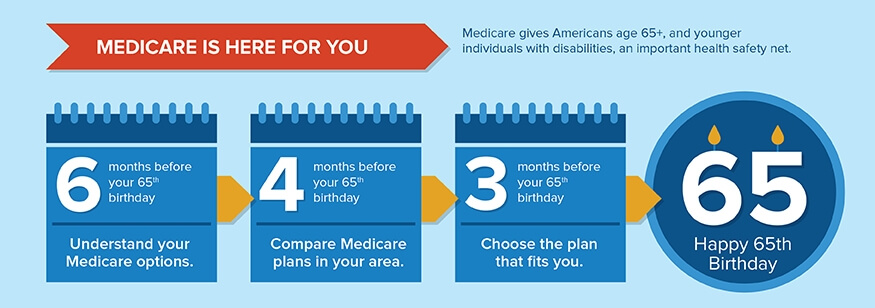

Medicare Mistake #1: Assuming Enrollment Is Automatic at 65

Medicare Mistake #1: Assuming Enrollment Is Automatic at 65 Turning 65 is often described as a milestone where Medicare “just starts.” For many people, that assumption is the first and most expensive Medicare mistake they’ll ever make. The truth is simple—but rarely explained clearly: Medicare is not automatic for everyone. And if you get this wrong, the consequences can follow you for the rest of your life. Why this mistake is so common Most people assume Medicare works like Social Security: You reach a certain age, and coverage begins. That can be true — but only in very specific situations. [...]

Why Medicare Advantage Plans Are So Attractive — Especially at First When people first become Medicare-eligible, many are shocked by how quickly the costs start adding up. Medicare is often [...]

If you look at the statistics, it feels obvious. The majority of people enrolling in Medicare today choose Medicare Advantage plans. That alone would make you assume they must [...]

Many Medicare beneficiaries believe that once they choose a plan, it will always be there. Unfortunately, that’s not how Medicare works. Every year, plans can: Exit a county Be [...]

Many people assume that if their Medicare plan worked last year, it will work again this year. That assumption feels reasonable.It’s also one of the most common Medicare mistakes. [...]

Many people on Medicare say the same thing when asked about prescription coverage: “I don’t take many medications, so I’ll worry about that later.” Unfortunately, that [...]

One of the most painful Medicare surprises happens after enrollment — when someone goes to schedule an appointment and hears: “We no longer accept your plan.” For many Medicare beneficiaries, [...]

One of the most common things people say when choosing a Medicare plan is: “I just want the cheapest option.” On the surface, that makes sense.Why pay more if you [...]

One of the most damaging Medicare mistakes doesn’t involve choosing the “wrong” plan.It happens before you ever compare options. That mistake is missing an enrollment deadline — often without realizing [...]

Medicare Mistake #1: Assuming Enrollment Is Automatic at 65 Turning 65 is often described as a milestone where Medicare “just starts.” For many people, that assumption is the first and [...]