Medicare Mistake #1: Assuming Enrollment Is Automatic at 65

Medicare Mistake #1: Assuming Enrollment Is Automatic at 65

Turning 65 is often described as a milestone where Medicare “just starts.”

For many people, that assumption is the first and most expensive Medicare mistake they’ll ever make.

The truth is simple—but rarely explained clearly:

Medicare is not automatic for everyone.

And if you get this wrong, the consequences can follow you for the rest of your life.

Why this mistake is so common

Most people assume Medicare works like Social Security:

You reach a certain age, and coverage begins.

That can be true — but only in very specific situations.

If you’re not actively enrolled in Medicare when required, you could face:

- Delayed coverage

- Gaps in care

- Permanent late-enrollment penalties

- Fewer plan options later

What makes this mistake especially dangerous is that no one automatically checks for you.

When Medicare is automatic — and when it isn’t

Medicare enrollment is automatic only if you are already receiving Social Security or Railroad Retirement benefitsbefore turning 65.

In that case:

- Medicare Part A and Part B usually begin automatically

- You’ll receive a Medicare card by mail

However, many people do NOT fall into this category.

If you are:

- Still working

- Delaying Social Security

- Covered under an employer plan

- Self-employed

- Retired but not drawing Social Security

👉 Medicare will NOT automatically start.

You must actively enroll.

The penalty people don’t see coming

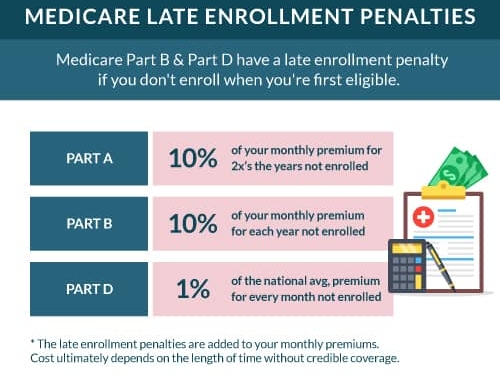

Failing to enroll on time doesn’t just delay coverage — it can create lifetime financial penalties.

For example:

- Late enrollment in Medicare Part B can result in a penalty added to your premium for as long as you have Medicare

- Late enrollment in Part D (prescription coverage) can also trigger ongoing penalties

These penalties are not one-time fees.

They compound year after year.

And the most frustrating part?

Many people don’t realize the mistake until years later — when it’s no longer fixable.

“But I had insurance through work…”

This is one of the most misunderstood Medicare scenarios.

Employer coverage may allow you to delay Medicare — but only under specific conditions, such as:

- The employer has enough employees

- The coverage is considered “creditable”

- The plan coordinates properly with Medicare

If any of those details are misunderstood or assumed incorrectly, you could still face penalties — even if you were insured the entire time.

This is where many people get caught off guard.

Medicare doesn’t warn you — and no one reviews this automatically

The official Medicare program (Medicare.gov) provides information, but it does not:

- Monitor your personal situation

- Notify you if you’re about to miss enrollment

- Tell you if your employer coverage qualifies

- Alert you before penalties apply

That responsibility falls entirely on you.

How to avoid this mistake entirely

Avoiding this mistake doesn’t require advanced knowledge — it requires confirmation, not assumptions.

Before turning 65, you should know:

- Whether you must actively enroll

- When your enrollment window opens and closes

- How your current coverage interacts with Medicare

- What happens if you wait

A short review before your 65th birthday can prevent decades of unnecessary costs.

The bottom line

Assuming Medicare enrollment is automatic is one of the most common — and costly — Medicare mistakes.

Medicare is full of rules, deadlines, and exceptions that don’t always make sense at first glance.

The people who run into trouble aren’t careless — they’re simply unwarned.

Before making any Medicare decisions, the most important question isn’t:

“What plan should I choose?”

It’s:

“Do I actually need to enroll right now?”

Getting that answer right protects everything that comes after.

Coming next in this series

Medicare Mistake #2: Missing Enrollment Deadlines That Trigger Penalties